working in nyc taxes

New Jersey residents who work in New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income. Overview of New York Taxes.

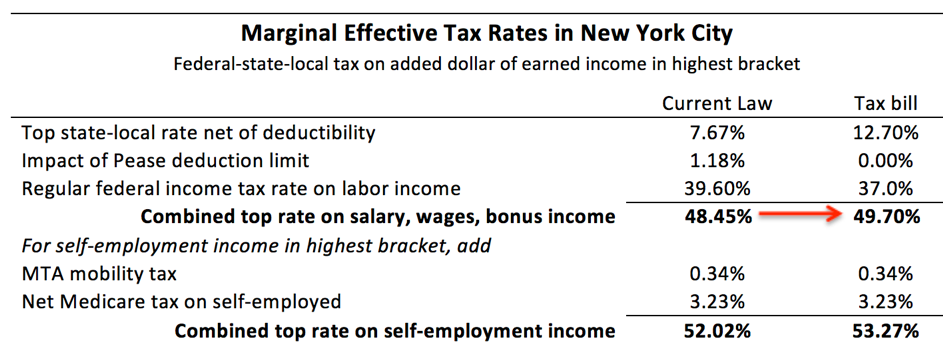

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

If this status is established days spent working at home outside of New York will not count as New York-based days and therefore will not be taxed by New York.

. It would of course be. The tax is collected by the New York State Department of. So if you live in New Jersey and work in New York City for example.

If you dont live in DC. New York Tobacco Tax. Besides NY part-year return you also file NJ-1040 resident return and make sure.

Best of all you wont have to pay NYC income taxes which only apply to residents of New York City. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. If an out-of-state employer agrees to withhold New York State New York City or Yonkers income taxes for the convenience of the employee then the employer is subject to.

As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the. The 2021-2022 New York State budget also gives homeowners a break in the form of a tax credit for any portion of real property taxes that exceeds 6 of their. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City.

You file and pay tax where the income is earned NYC You then get a deduction for that tax when you file. The tax is collected by the New York State Department of Taxation and. Residents of New Jersey who work in New York will fill out both an NJ.

This memorandum explains the Tax Departments existing policy concerning employer withholding on the wages paid to certain. Residents of California Indiana Oregon and Virginia are exempt from paying income tax on wages earned in Arizona. On the other hand many products face higher rates or additional charges.

Restaurant Return-To-Work Tax Credit Program Quarterly Report - Q3 2022. Thus under normal circumstances the income of a NYC resident who worked 100 remotely from a NY location would not be subject to MA taxation. Job Listings From Thousands of Websites in One Simple Search.

You work for a New York company and New York taxes is withheld from your paychecks. All jobs Find your new job today. Cigarettes are subject to an excise tax of 435 per pack of 20 and other.

Who Work 14 Days or Fewer in New York State. The Restaurant Return-To-Work Tax Credit Program incentivized COVID-impacted restaurants to bring. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City.

/GettyImages-538594694-791e2c621e27472fbdf9a3f1b7cfcb67.jpg)

Benefits Of Living In Nj While Working In Nyc

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

If I Work In Ny But Live In Nj Do I Pay Taxes In Both States

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How To Avoid New York City Taxes Quora

What Is A 421a Tax Abatement In Nyc Streeteasy

What Taxes Do You Pay If You Live In New York City Work In New Jersey Sapling

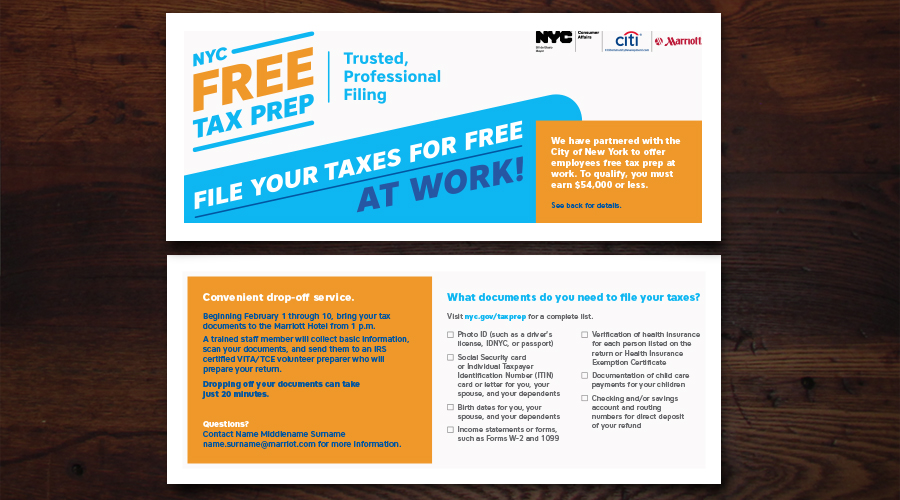

Tythedesign Nyc Dept Consumer Affairs Promoting Free Tax Preparation

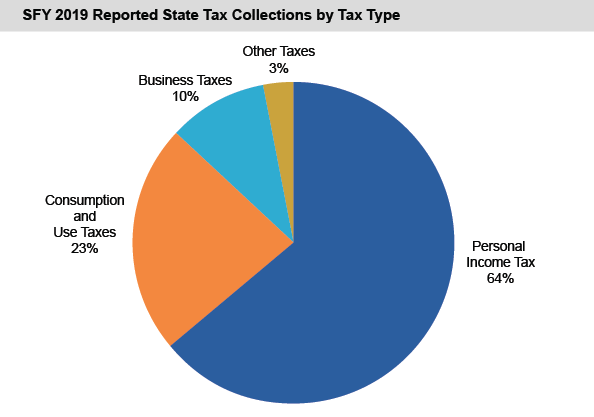

Tax Collections Plunge In Wake Of Stock Market Downswing The City

Taxes Office Of The New York State Comptroller

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

How Much Will I Pay In Income Tax While Working On An H1b In The Us

What S The New York State Income Tax Rate Credit Karma

Solved Remove These Wages I Work In New York Ny And Live In New Jersey Nj

Mansion Tax Nyc Everything You Need To Know Yoreevo Yoreevo

Us New York Implements New Tax Rates Kpmg Global

Become An Nyc Free Tax Prep Volunteer